เข้าร่วม PU Xtrader Challenge วันนี้

ซื้อขายด้วยเงินทุนจำลองและทำกำไรจริงหลังจากที่คุณผ่านการประเมินของเรา trader assessment.

เข้าร่วม PU Xtrader Challenge วันนี้

ซื้อขายด้วยเงินทุนจำลองและทำกำไรจริงหลังจากที่คุณผ่านการประเมินของเรา trader assessment.

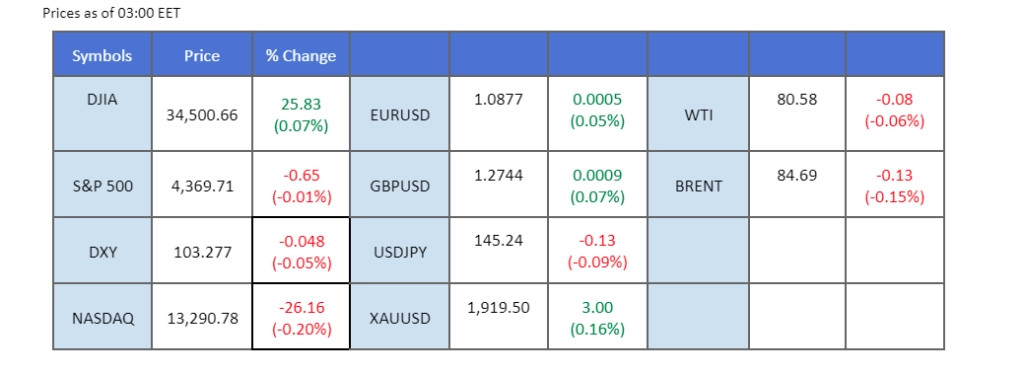

Asian stock markets are on track for a weekly decline, partly influenced by China’s economic challenges and the prevailing global high-interest rate environment. A notable increase in the global government bond yield, reaching a level not seen in 15 years, has sparked concerns among investors about a potential worldwide economic downturn. Meanwhile, the US dollar remains strong, and there’s a slight uptick in gold prices, reflecting a shift in investor sentiment towards safer assets. In a separate development, Japan’s core Consumer Price Index (CPI) has eased to 3.1% from its previous reading of 3.3%. This moderation in inflation has provided the Bank of Japan (BoJ) with reasons to maintain its current monetary policy stance. Conversely, the euro has gained strength following positive news about the Eurozone trade balance, which has improved from a deficit of -0.3 billion to a surplus of 23 billion.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The resolute climb of the US Dollar persists, as global investors keenly await insights from Federal Reserve Chair Jerome Powell. His forthcoming statement holds the promise of shedding light on both the economic outlook and the intricate path ahead for interest rates. Notably, recent economic indicators and the central bank’s July meeting have underscored inflation concerns, hinting at a prolonged phase of monetary tightening.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 56, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 103.60, 104.45

Support level: 102.60, 102.00

The landscape for gold remains tenuous, with the precious metal presently testing a pivotal support level. The robust surge of the US Dollar, coupled with the ascent of US treasury yields in anticipation of Jerome Powell’s forthcoming statements, emerges as the primary bearish impetus for the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing diminishing bullish momentum, while RSI is at 36, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1910.00, 1930.00

Support level: 1890.00, 1860.00

The dollar index is positioned close to the $103 threshold, while the euro remains under downward pressure, trading below 1.0900 against the USD. Additionally, investors are anticipating the release of the German Producer Price Index (PPI) to assess the eurozone’s economic condition and measure the euro’s strength. Nonetheless, the spotlight will truly be on Thursday, as Jerome Powell is set to deliver a speech at the Jackson Hole Economic Symposium. During the 3-day event from August 24th to August 26th, investors will closely analyse the signals provided by the Federal Reserve regarding the future trajectory of interest rates.

The pair volatility has decreased while the euro is trading sideways at below the 1.0900 level. The RSI has been flowing at the lower region while the MACD stays flat at below the zero line, both suggesting a neutral-bearish bias for the pair.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

1.2780 to 1.2670. Currently, it is nearing the resistance level of its downward trend. The consistent hawkish stance adopted by the Bank of England (BoE) has enabled the British pound (Sterling) to withstand the pressure from the robust dollar throughout the previous week. Investors will be closely observing the UK’s manufacturing and service Purchasing Managers’ Index (PMI) data for insights into the strength of the Sterling. Simultaneously, investors also caution regarding the impact of Jerome Powell’s speech at the Jackson Hole Economic Symposium, as it could influence both the dollar and the Cable.

Sterling is approaching the downtrend resistance level; a breakout at such a point will serve as a solid trend reversal signal for the Cable. The RSI is moving flat while the MACD is moving closely with the zero line; both have given a neutral signal for the Cable.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

The Japanese yen has exhibited strength against the US Dollar, following its decline to its lowest point against the USD since last November. Notably, the Bank of Japan (BoJ) is engaging in an unprecedented pace of government bond purchases this year, as Japan adopts a broader range for yield fluctuations within its Yield Curve Control (YCC) strategy. Furthermore, Japan has sustained inflation rates surpassing the central bank’s 2% target for the 16th consecutive month, prompting market speculation about the potential conclusion of the Yield Curve Control policy. A clear shift away from YCC is anticipated to yield a bullish impact on the Japanese yen.

The USD/JPY pair is traded out of the uptrend channel, exhibiting a trend reversal for the pair. The RSI has dropped out of the overbought zone while the MACD has crossed, signalling a trend reversal as well.

Resistance level: 145.60, 146.45

Support level: 144.90, 144.00

The US equity market remained bearish, as participants digested the looming specter of Federal Reserve-driven rate hikes and the consequential ascent of government bond yields. This contemplative atmosphere translated into a gradual decline in the US equity market.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 35605.00, 36520.00

Support level: 34415.00, 33715.00

The recent confluence of property and economic crises within China has cast a shadow of scepticism over Chinese-proxy currencies, including the Australian and New Zealand Dollars. Economists’ downward revisions of Chinese GDP growth forecasts and the apprehension surrounding the nation’s ability to attain its 2023 growth target of 5.0% have intensified these concerns. The simultaneous erosion of trade activity and the unravelling property sector augments the gravity of these risks, warranting vigilance among investors.

AUD/USD is trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6465, 0.6600

Support level: 0.6385, 0.6285

Oil’s strong bullish momentum is limited by China’s economic uncertainties, as worries about demand persist due to China’s slow post-Covid recovery and property sector struggles. Despite these hurdles, strategic OPEC+ production cuts and the prospect of increased demand post-summer offer solid backing for oil prices. Amid mixed sentiment, vigilant monitoring of triggers is crucial for investors seeking actionable trading insights.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 83.25, 87.25

Support level: 79.00, 76.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment